In today’s competitive e-commerce landscape, offering payment installment options can significantly boost your sales and improve customer satisfaction. By allowing customers to spread their payments over time, you make it easier for them to afford larger purchases and increase the likelihood of conversion. Here’s how to effectively implement payment installment options in your e-commerce business.

Table of Contents

Toggle1. Choose the Right Payment Partner

Start by selecting a payment provider that offers flexible installment options. Look for partners that provide seamless integration with your existing e-commerce platform and offer various payment plans, such as monthly or bi-weekly payments. Popular options include:

- Afterpay

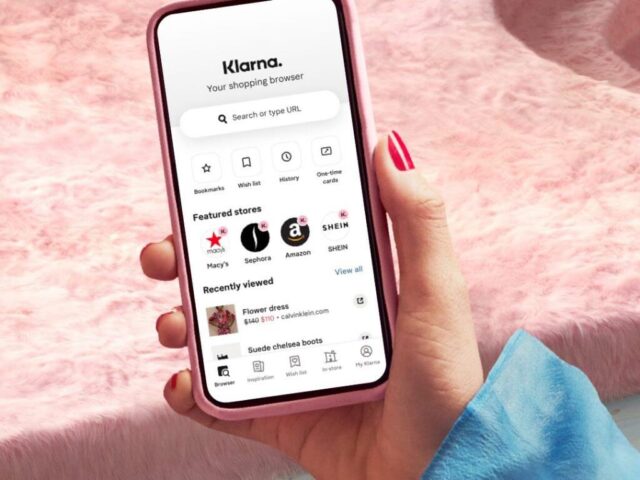

- Klarna

- Affirm

- Splitit

Evaluate their fees, terms, and user experience to ensure they align with your business goals.

2. Integrate Payment Options Seamlessly

Once you’ve chosen a payment partner, integrate their solution into your checkout process. Ensure that the payment options are clearly displayed and easy to navigate. A smooth integration enhances the customer experience and reduces cart abandonment.

- Tip: Consider adding a “Buy Now, Pay Later” button prominently on product pages and at checkout to make it visible and accessible.

3. Communicate Benefits Clearly

Educate your customers about the benefits of payment installments. Clearly communicate how this option works, including any fees, interest rates, and the repayment schedule. Highlight the advantages, such as:

- Affordability: Breaking down larger purchases into manageable payments.

- Flexibility: Customizing payment plans that fit their budget.

- No hidden fees: Transparency in costs can build trust.

- Tip: Use visuals or infographics to illustrate the payment process, making it easy for customers to understand.

4. Promote Installment Options in Marketing Campaigns

Incorporate payment installment options into your marketing strategies. Highlight this feature in your email newsletters, social media posts, and promotional materials. Creating targeted ads that emphasize affordability can attract customers who may have previously hesitated to purchase due to budget constraints.

- Tip: Use testimonials or case studies from customers who benefited from installment payments to build credibility.

5. Train Your Customer Support Team

Ensure that your customer support team is well-versed in the payment installment options you offer. They should be able to answer questions and guide customers through the process. A knowledgeable support team can alleviate any concerns and increase customer confidence in making a purchase.

- Tip: Provide FAQs and troubleshooting resources related to payment installments for easy reference by your support team and customers.

6. Implement a Simple Approval Process

Streamline the approval process for payment installments to reduce friction. Customers are more likely to engage with options that provide instant approval without extensive documentation. Choose payment partners that offer quick, automated approvals to enhance the customer experience.

- Tip: Clearly communicate approval times on your website to manage customer expectations.

7. Optimize for Mobile Users

As mobile shopping continues to rise, ensure that your payment installment options are mobile-friendly. Optimize your checkout process for mobile devices, making it easy for customers to select payment plans from their smartphones or tablets.

- Tip: Test the mobile user experience thoroughly to identify and resolve any potential issues before launch.

8. Monitor Performance and Adjust Strategies

After implementing payment installment options, closely monitor their performance. Analyze metrics such as conversion rates, average order value, and customer feedback to gauge the effectiveness of the new payment method.

- Tip: Use A/B testing to compare sales performance with and without payment installments to determine their impact on your business.

9. Encourage Repeat Purchases

Once customers have successfully used installment options, encourage them to return for future purchases. Follow up with personalized emails offering discounts or incentives for repeat purchases.

- Tip: Create a loyalty program that rewards customers for using installment options, fostering long-term relationships and increasing customer retention.

10. Stay Compliant with Regulations

Ensure that your payment installment offerings comply with relevant regulations and consumer protection laws. Stay informed about any changes in legislation related to financing and credit to protect your business and customers.

- Tip: Consult with legal experts to review your installment agreements and policies to ensure compliance.

Conclusion

Adding payment installment options can be a game-changer for your e-commerce business, enhancing affordability and driving higher sales. By selecting the right payment partner, integrating seamlessly, and promoting the benefits effectively, you can create a more appealing shopping experience for your customers. Monitor performance and continuously refine your strategies to maximize the advantages of offering payment installments, ultimately leading to increased conversions and customer loyalty.

No responses yet